The mobile space is exploding. No duh. And it’s no surprise that mobile payments are predicted to hit $171.5 billion—with a “b.” After all, mobile technology isn’t just changing the way people view websites and consume content—it’s changing how we pay for things, too.

The mobile space is exploding. No duh. And it’s no surprise that mobile payments are predicted to hit $171.5 billion—with a “b.” After all, mobile technology isn’t just changing the way people view websites and consume content—it’s changing how we pay for things, too.

And doesn’t that make sense? If you’re anything like me, your phone is never far from your hand (in fact, for a good portion of the day, it’s IN your hand). And since we can do so many things with our phones these days, it stands to reason that we should be able to pay for goods and services, too.

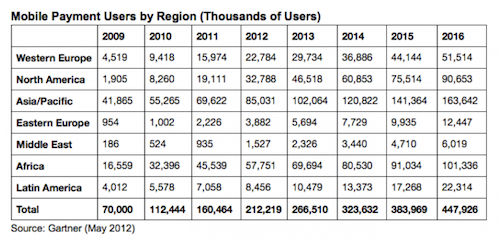

This sort of realization is evident in Gartner’s research and projections, which doesn’t only indicate an increase in mobile payments—it also predicts that the number of mobile payment users will grow, too—212.2 million this year, compared to 160.5 million in 2011, as shown in the chart below.

If you’re part of a transaction-based business, consider this your clue to start formulating not just an overarching mobile strategy, but mobile payment functionality, too. This likely doesn’t come as a shock, but the mobile payment market will only continue to grow from here. In fact, Gartner is predicting 42 percent annual growth between 2011 and 2016, resulting in a market that’s worth a whopping $617 billion by 2016.

And that’s why this is the perfect time to assess where your business falls in terms of mobile functionality. Do you have mobile payment capabilities in place? If not, what do you need to do in order to offer that solution? And how will that payment portal work in conjunction with your larger mobile presence in order to offer consumers a streamlined, optimized experience that allows them to access your company and services regardless of what device they’re using?

Sure, mobile payments are one more thing you’ve got to think about, plan for and strategize. Yet it’s important to recognize that this is a significant by-product of the mobile explosion, and mobile capabilities and demands are going to become only more widespread from here.

If your company offers goods and services, do you have a mobile payment option available? And if so, have you noticed an increase in customer demand for this functionality?

Lead image via SiliconAngle.com