One of the best thing about attending the wide variety of tech events that I’m invited to is the opportunity to hear stories from companies not on my radar screen who are doing some amazing things. The PegaWorld 2017 event hosted by PegaSystems software generally manages to put companies on my radar screen that I’ve not paid much attention to before, and that’s the case for this year’s event, where I had the pleasure of listening to Jason Charlebois, Scotiabank’s SVP of technology. Scotiabank is a Canadian multinational bank, the third largest in Canada by deposits and market capitalization.

One of the best thing about attending the wide variety of tech events that I’m invited to is the opportunity to hear stories from companies not on my radar screen who are doing some amazing things. The PegaWorld 2017 event hosted by PegaSystems software generally manages to put companies on my radar screen that I’ve not paid much attention to before, and that’s the case for this year’s event, where I had the pleasure of listening to Jason Charlebois, Scotiabank’s SVP of technology. Scotiabank is a Canadian multinational bank, the third largest in Canada by deposits and market capitalization.

Charlebois’ impressive presentation told the story of how a 185-year old banking and financial services institution is leading the financial tech (FinTech) revolution. FinTech companies are all too often startups who sneak in and compete directly against established financial institutions who are slow to embrace change and operate with a customer-centric focus. Seeing a financial institution, and one this mature, realize the need to transform everything about their business operations, and commit to breaking apart the traditional banking relationship and how customers view, and work with their banks was inspiring.

Charlebois led off with Scotiabank’s credo:

Never stop

Never stop Innovating for customers

New stop Creating for customers

Never stop doing more than theorizing theories

Never stop making things that customers can use to make banking better

That’s exactly what success in today’s FinTech sector is all about—always thinking, imagining, accomplishing, and transforming everything about banking, and about financial services, that truly serves the customer, and makes their customer experience a great one.

Who is Scotiabank?

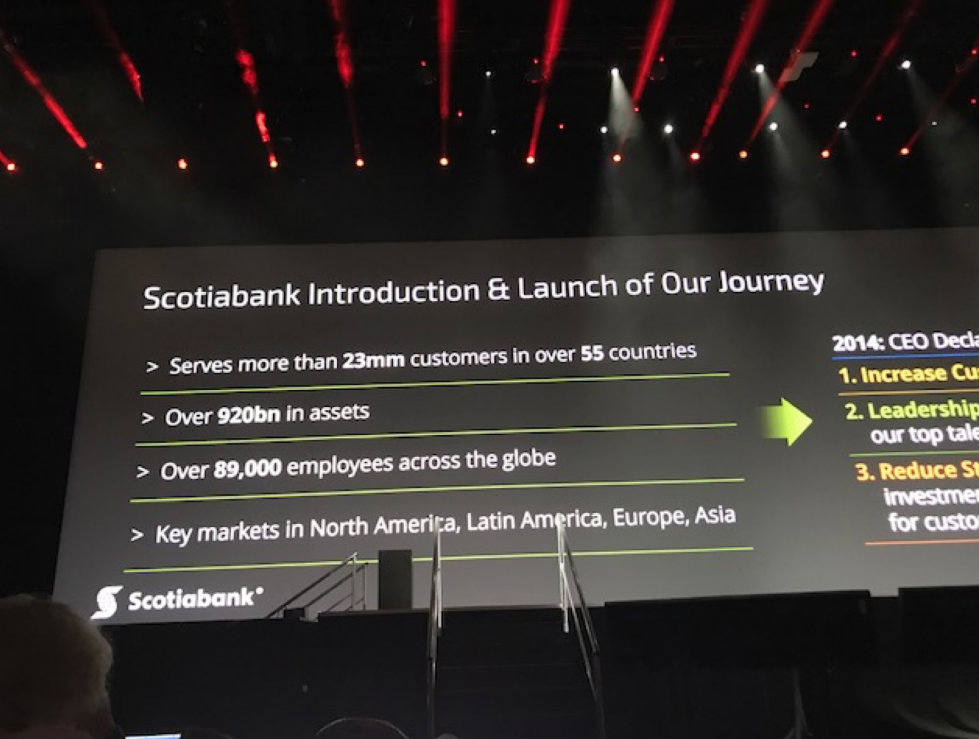

Scotiabank is a global bank operating in many countries around the world, focused primarily in Canada, Latin America, as well as Europe and Asia. With almost a trillion dollars in assets and close to 90K employees serving over 23 million customers.

Digital transformation in FinTEch: “We’re in the technology business”

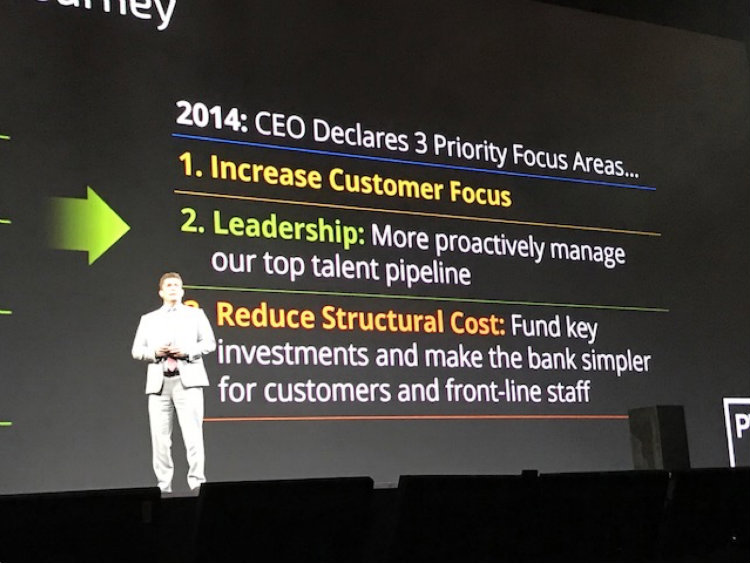

Scotiabank’s process of digital transformation started when CEO Brian Porter took the helm in 2013. Porter implemented immediate change, cutting jobs (including executive ones), focusing on culture change, and selling assets deemed burdensome or unnecessary. Porter’s strategy touched virtually every division within the bank and resulted in some $500+ million in changes. In a 2016 interview, when asked about his strategy, Porter said simply: “We’re in the technology business. Our product happens to be banking, but largely that’s delivered through technology.”

Coming into his role, Porter understood the process of digital transformation that was taking place in the financial tech world and how digital native companies that were transforming how companies were doing things differently. They were thinking differently about their customers, and focusing on serving them better. Smart companies were also thinking about their internal teams and how serving customers better was going to rely on having top tech talent.

Where to start? Broaden horizons, broaden perspectives

When you’re embarking on a rapid digital transformation process leading a 185-year-old company, figuring out where, and how to start is key. Porter realized that Scotiabank and its management team, like so many other companies today, had long been internally focused. He knew that they needed to get outside their own minds, and the walls of the business they’d built, and look at the world through new eyes. That meant exploring what industries other than banking were doing to embrace digital transformation, observing how customer expectations were changing, and how the best companies in the world, the ones with the most customer-centric focus, were thinking about the world and what they were doing to effect change within their organizations and serve their customers better.

Broaden horizons, broaden perspectives. It totally makes sense, doesn’t it?

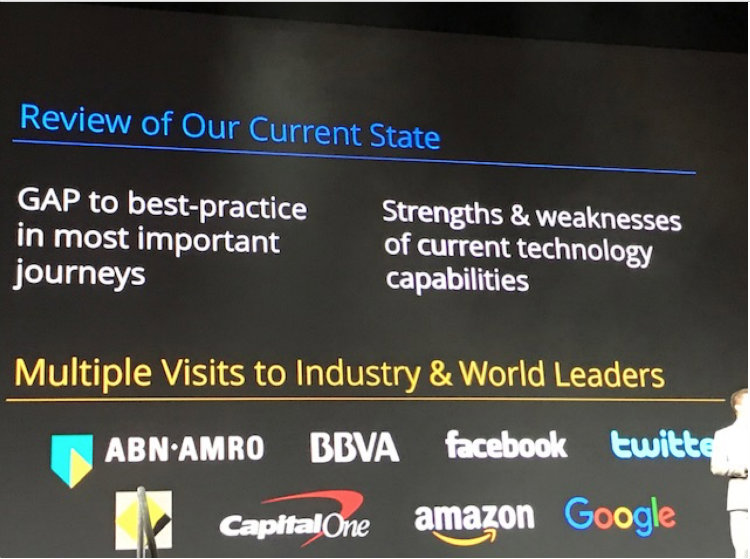

How’d they do it? Scotiabank committed to understanding their customer journeys and the best practices they could put in place to make those customer journeys effective and enjoyable—for customers, not for the bank. They turned a laser focus on their technology solutions and analyzed strengths and weaknesses of their systems. They also got outside. Outside their country, outside their industry, outside their own minds. They visited best-in-class companies all over the world in an effort to observe, learn, and take back lessons from those best-in-class companies to implement at home.

Keys to success? Focus, then execute

When you’re navigating the process of digital transformation, while it’s admirable to want to effective massive change all at once, the reality is that that’s most often not possible. Smart companies pick key initiatives and focus on those. That’s what Scotiabank did with its digital transformation journey.

Scotiabank identified three key areas of focus:

- Embrace the customer. Make the customer experience with the bank the best experience they have with any financial institution. No small undertaking, there.

- Recruit, manage, retain the top talent that it’s going to require to be this technology company that we are.

- Reduce the reliance on bricks and mortar locations. Real estate is expensive. Why invest in real estate when customers want to bank online? Equally as important to a more digitally oriented presence is the ability to identify and eliminate inefficiencies along the way.

People + Technology + Innovation = Idea Factories

Scotiabank rolled out many initiatives along the way, but one of my favorite that Charlebois touched on was their “Idea Factories.” Idea factories allow teams to work rapidly. Ideas are developed, delivered, connected with scale and speed to where Scotiabank’s customers already are.

They quit hiring bankers and working bankers’ hours and instead focused on attracting talent from and where talent lives. The talent they recruit today is the best in breed tech talent. They look for team members that are agile and fast, with the ability to think it, build it, test it, see it fail, not stop, improve it, use it, figure it out, launch it—and then move on and do it all over again.

The reality is this: That is true of every single business today. Let’s look at that again, in slow motion:

Agile and fast

The ability to think it, build it, test it.

See it fail and not stop.

Start over, improve it, use it.

Figure it out, launch successfully.

Do it all over again.

Digital Transformation: Why Scotiabank is nailing it

Porter and Scotiabank are succeeding because for them, digital is everywhere. Why? Because their customers are everywhere. Digital transformation isn’t just a buzzword, it’s a lifestyle. It’s the lifeblood of their business, this embracing of technology and digital and the putting of their customers before all else.

And it’s clear that this is far from the end of their digital story, it’s just a beginning for them. Why? Because the world we’re living in today is changing at the speed of sound, and business has to be prepared to change with it. When you build your business in a way that allows for that continual morphing, and adapting, always with a view toward providing the very best customer experience possible, it’s going to work.

Want to follow Scotiabank’s example and make it work in your organization? It’s really pretty simple. Don’t mistake that to read inexpensive or easy, because it’s not either of those things. But it is simple:

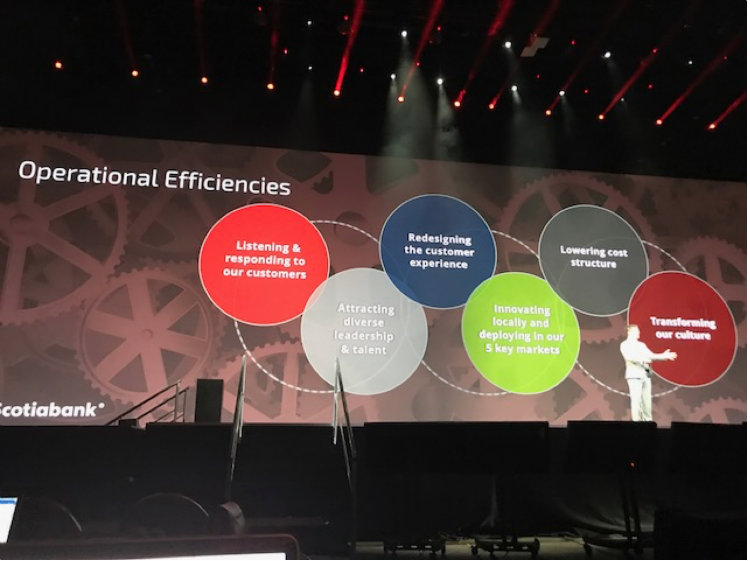

- Listen to your customers, provide what they want and need

- Diversity matters. Attract folks with diverse skill sets and a different way of thinking to your leadership and talent team.

- Redesign everything about the customer experience. Make it everything they’ve ever wanted, and more.

- Innovate locally, and deploy throughout your various markets

- Lower your cost structure wherever and whenever possible

- Never stop transforming your culture

Want to succeed at digital transformation? Whether you’re in the financial tech sector or any other vertical, take the strategy developed by Scotiabank’s Brian Porter and team and put it to work in your business. No matter the size of your company, enterprise or small-to-midsize, the lessons here, and the soundness of this strategy, are the same. It will work. It does work.

I would be remiss not to mention here that part of the reason for Porter and Scotiabank’s success was adopting software solutions and working with vendor partners that allowed them to accomplish the things they wanted to accomplish, and the solutions offered by Pega Systems no doubt played a role. I think it’s fair to say that if you’re exploring this route for your company, checking out their offerings makes good sense. Also, mark your calendars for the 2018 PegaWorld event June 3-6 in Las Vegas.

Disclosure: The opinions here are my own, I attended PegaWorld 2017 as a guest of PegaSystems.